As innovative business models emerge in the wealth management industry, retention is becoming increasingly challenging for wealth managers, according to a report published by Ernst & Young in May 2019.

Strengthening personal relationships with clients is one of the best ways to combat disloyalty.

Ernst & Young’s 2019 Global Wealth Management Research report identifies the different ways that wealth managers can build value when clients want more than just increased returns.

The firm discovered through its research that one third of surveyed clients plan to switch wealth management providers over the next three years. Clearly, there is a retention problem brewing in the wealth management market.

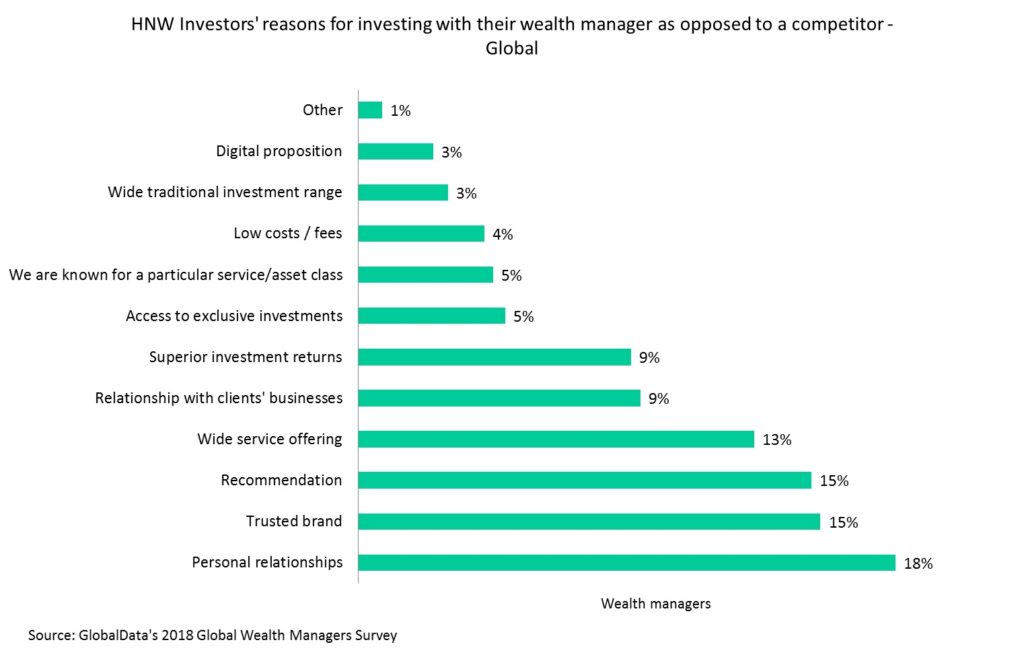

According to our data, personal relationships are the leading reason why high-net-worth (HNW) investors choose their wealth manager as opposed to other players, though it only narrowly led a lengthy package of reasons.

According to our data, personal relationships are the leading reason why high-net-worth (HNW) investors choose their wealth manager as opposed to other players, though it only narrowly led a lengthy package of reasons.

Introducing training schemes that help advisers develop their interpersonal skills will be beneficial; the better the connection with their clients, the more likely they are to remain.

However, the importance of personal relationships does not end at the current HNW client base.

Our data shows that on a global scale, giving the next generation first-hand experience in the managing of family wealth with investment advisers as early as possible is key. With the inter-generational transfer on the horizon, those that have not started building these relationships should do so quickly.

The wealth management industry is experiencing increased competition and change, to which advisers must remain adaptive.

To minimize the risk of competitors switching to new entrants or other incumbents, more focus should be placed on strengthening personal relationships with current HNW investors and the next generation.

Source : verdict.co.uk